Comprehensive income connotes the detailed income statement, where we will also include income from other sources and the income from the main function of the business. This allocation process can be cumbersome and will require more time, effort, and professional judgement. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Net income is the actual profit or gain that a company makes in a particular period.

Comprehensive Guide to Inventory Accounting

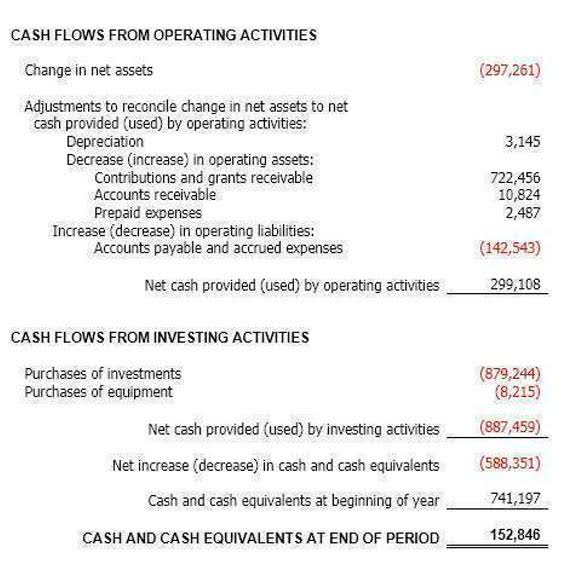

This metric evaluates the efficiency of a company at utilizing its https://www.facebook.com/BooksTimeInc labor and supplies in producing its goods or services. However, it uses multiple equations to determine the net profit of the company. After the CI statement is prepared, we can start preparing the balance sheet.

Step 1 of 3

- The OCI figure is crucial however it can distort common valuation techniques used by investors, such as the price/earnings ratio.

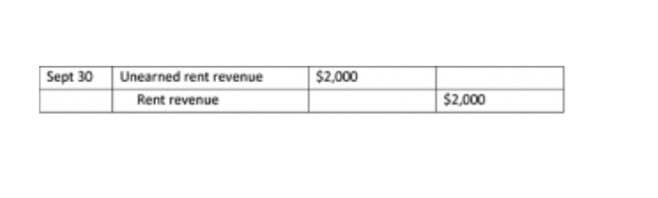

- If you’ve not yet got all of the payments, your revenue comprises all of the money generated for your services throughout the reporting period.

- Losses can be the result of one-time or any other extraordinary expenses, or lawsuit expenses.

- Unrealized income might come from non-owner sources, including gains due to foreign currency transactions, fluctuating asset values, and hedge financial instruments, among other financial events.

- Comprehensive income is a broader measure of a company’s financial performance than net income alone, as it takes into account a wider range of factors that can impact a company’s equity position.

CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path. Pension and retirement plans are extremely popular investments for statement of comprehensive income many companies. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

What is Qualified Business Income?

It also emphasises both current and accumulated expenditures, which are expenses that the firm has yet to pay. However, if a company’s assets or liabilities contain a significant unrecognized gain or trial balance loss, it might have a significant impact on the company’s future sustainability. Even though the income statement is a standard tool for measuring a company’s financial health, it falls short in key areas.

- For non-SEC registrants, there is limited guidance on the presentation of the income statement or statement of comprehensive income, like IFRS.

- You can think of it like adjusting the balance sheet accounts to their fair value.

- The income statement is one of the most essential parts of the statement of comprehensive income.

- However, it uses multiple equations to determine the net profit of the company.

- So rather than have a clear principles based approach on reclassification what we currently have is a rules based approach to this issue.

- Comparing a company’s current performance with its past performance creates trends that can have a predictive, though not guaranteed, value about future earnings performance.

Net income is the traditional measure of a company’s profitability and is calculated as revenues minus expenses. Other comprehensive income includes gains and losses that bypass the income statement and are instead recorded directly in equity. These gains and losses may include items such as unrealized gains or losses on available-for-sale securities, foreign currency translation adjustments, and gains or losses from cash flow hedging activities. The purpose of comprehensive income is to show all operating and financial events that affect non-owner interests. As well as net income, comprehensive income includes unrealized gains and losses on available-for-sale investments. It also includes cash flow hedges, which can change in value depending on the securities’ market value, and debt securities transferred from ‘available for sale’ to ‘held to maturity’—which may also incur unrealized gains or losses.

![]()