Next, we will conclude with a summary of the importance of net credit sales in financial statements and decision-making. The cash flow from operations section starts with the net income from the income statement and makes adjustments for any non-cash items included in the net income. These adjustments include depreciation and amortization expenses, changes in working capital, and other non-cash expenses or gains. But this is going to increase the number of customers when you are going to calculate the exact number of the net credit sales.

Examples of Net Credit Sales Calculation

The discount is deduced from gross sales on the income statement by the amount of the journal entry. Begin by finding the total credit sales revenue generated during the accounting period. Gross credit sales are simply all the sales made where the customer paid using credit. Think of it as the total amount of sales you rack up when customers use credit cards or other credit options.

The Importance of Accounts Receivable Turnover Ratio

- As a result, the number for net credit sales is frequently used to determine accounts receivable turnover.

- Analyzing net credit sales over time and comparing them to industry peers can help identify trends, market competitiveness, and potential areas for improvement.

- Ignoring these figures can lead to an inflated net credit sales number, which gives you a false sense of security about your revenue.

- When a customer returns a product, or you issue a partial refund for a defective item, those amounts need to be deducted from your gross credit sales.

- This is because the accrual method of accounting recognises revenue when it is earned and expenses when they are incurred, and matches revenues with expenses during specific accounting periods.

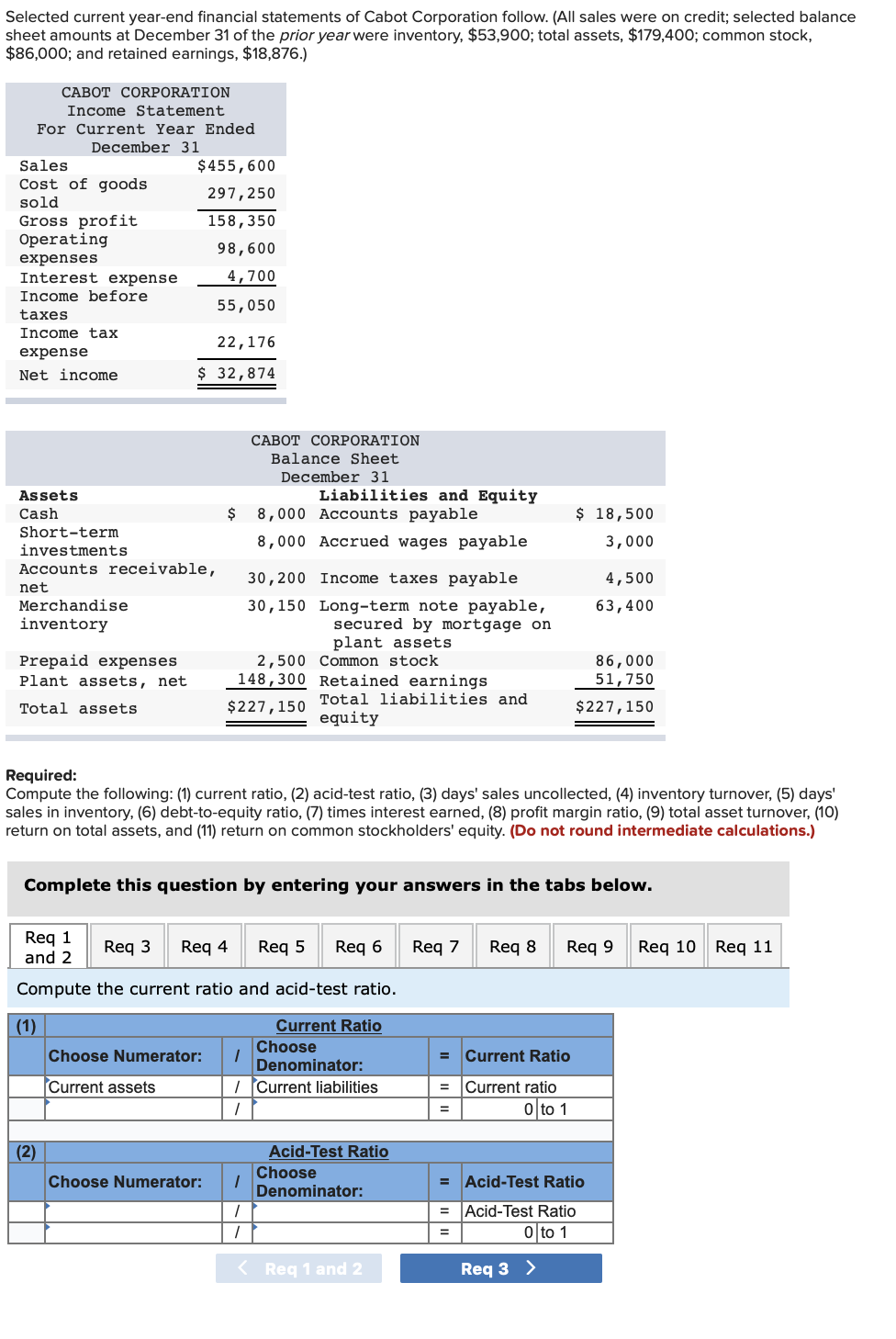

The total sales of a company are recorded in the sales revenue account on the income statement. When a sale is made on credit, the amount of credit granted to customers is also granted a sales allowance. Also, sales returns and allowances are subtracted from the total sales where to find net credit sales on financial statements to calculate net sales. Furthermore, credit sales refer to sales that are made on credit, where customers are allowed to pay at a later date. Net sales in financial statements play a crucial role in reflecting the worth of sales made on credit to customers on credit.

Statement of Cash Flows

This means that net credit sales do not include any sales made on cash, but they do take into account sales return and sales allowances. Once you deduct sales returns, discounts, and allowances from gross sales, the remaining figure is your net sales. Implied in this question is an important analytical point for investors to consider when measuring the quality of a company’s operations and balance sheet. In the case of the latter, the accounts receivable line in a company’s current assets records its credit sales.

Gross sales are the total amount of credit sales recorded, while net credit sales refer to the sales after deducting any sales allowance or credit arrangements. To calculate the accounts receivable turnover, companies must collect on their credit sales and reduce the total sales by reducing total sales. Credit sales are also crucial in determining the company’s financial health and success.

Calculating Net Credit Sales on a Balance Sheet

It’s essential to calculate accounts receivable turnover to understand how quickly a company can collect on its credit sales. Net credit sales, referring to the worth of credit sales after deducting any sales returns or allowances, play a crucial role in this calculation. To determine credit sales using accounts, consider the sales values between sales returns and calculate ratios such as receivables turnover.

It refers to the revenue that remains after considering the direct costs related to the manufacturing of products or services that you sell. You need to use an accrual method of accounting while recording sales in your books of accounts. This is because the accrual method of accounting recognises revenue when it is earned and expenses when they are incurred, and matches revenues with expenses during specific accounting periods. Your business revenues indicate the total amount that your customers pay for selling goods and services to them.

One customer returns $600 worth of the items because of a problem with the products. You gave another customer a $100 credit because you failed to take their coupon into account originally. Sales returns occur when your company gives customers a refund or credit after they purchase goods or services from you. This usually happens because of a problem with the product, such as issues with a shipment or service. Credit sales are recorded when a company has delivered a product or service to a customer (and thus has “earned” the revenue per accrual accounting standards).

The profit and loss statement also includes the constant revenue and costs sections. Net Sales, Cost of Goods Sold (COGS), Gross Margin, Selling and Administrative Expenses, and Net Profit are examples of these categories. Customers pay these totals with credit, meaning you still need to collect payment. As the cash flow statement shows the movement of cash into and out of the business, when customers make payments for their credit purchases, this results in a positive cash inflow.

As a result, it debits a sales returns and allowances account (or the sales revenue account directly) and credits a cash or accounts receivable account. Understanding the income statement and the significance of net credit sales is crucial for investors and stakeholders to make informed decisions. By analyzing the income statement, stakeholders can gain insights into a company’s revenue generation, profitability, and financial stability. The net credit sales figure is subtracted from the COGS and other operating expenses to calculate the gross profit and operating profit. It provides a snapshot of the company’s financial performance and helps stakeholders assess its profitability.

You can download our free accounts receivable turnover calculator from the banner below. Allowances are the grants you give to your customers when they agree to keep the merchandise at a price lower than the original selling price. You as a seller have to provide such grants on account of the inferior quality, or wrong goods sent to the customers. For instance, a manufacturing unit would have more sales return relative to a small retail store. The value of your business’s net sales is always less than or equal to the value of its gross sales. This necessitates the insertion of extra notations in order to account for the item as inventory.

![]()